Overall Telephone Connections Grow Steadily

By the end of September 2025, India counted 1228.94 million telephone subscribers. That is up by 4.4 million from August. The monthly growth came in at 0.36 percent. Wireless services, which include mobile and fixed wireless options, make up the bulk with 1182.32 million users. Wireline stands at 46.61 million.

In cities, telephone users reached 689.11 million, while rural areas had 539.83 million. Urban areas saw a net addition of 2.32 million, and rural added 2.08 million. The growth rate in villages was a bit higher at 0.39 percent compared to 0.34 percent in towns.

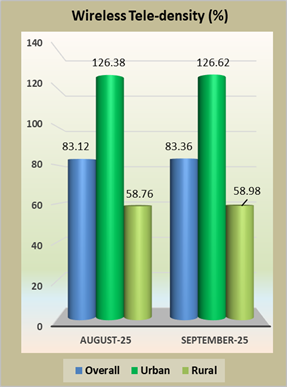

Tele-density, which shows how many connections per 100 people, now sits at 86.65 percent across India. Cities boast 134.76 percent, thanks to multiple SIMs per person, while rural stands at 59.52 percent. About 56 percent of all subscribers live in urban zones, and 44 percent in rural.

Wireless Dominates the Scene

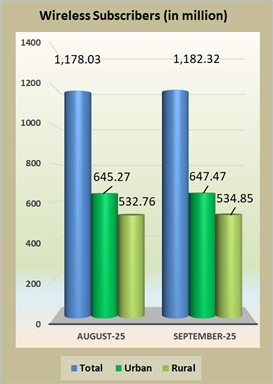

Wireless connections grew from 1178.03 million in August to 1182.32 million in September, adding 4.29 million users. That translates to a 0.36 percent monthly rise. Urban wireless hit 647.47 million, rural 534.85 million.

Out of the total wireless base, mobile alone accounts for 1170.44 million, with fixed wireless access at around 11.88 million when you combine 5G FWA and UBR types. Active mobile users, based on peak visitor location register data, stood at 1088.59 million, which is about 93 percent of the mobile subscriber base.

Private operators hold 92.10 percent of the mobile market, while public sector players like BSNL and MTNL share 7.90 percent.

Fixed Wireless Access Picks Up Pace

Fixed wireless services are gaining ground. 5G fixed wireless access grew to 9.40 million users, with 5.53 million in cities and 3.87 million in villages. Another variant using unlicensed band radio reached 2.48 million, mostly reported by one major player.

Broadband Users Cross 995 Million

Broadband connections jumped from 989.58 million to 995.63 million, a healthy 0.61 percent growth in one month. Wireless broadband, mainly through mobile devices, leads with 938.92 million. Fixed wireless added 12.31 million, and traditional wired broadband reached 44.40 million.

Wired options grew by 0.75 percent, fixed wireless by almost 8 percent, and mobile wireless by 0.51 percent. This shows people love the flexibility of wireless internet.

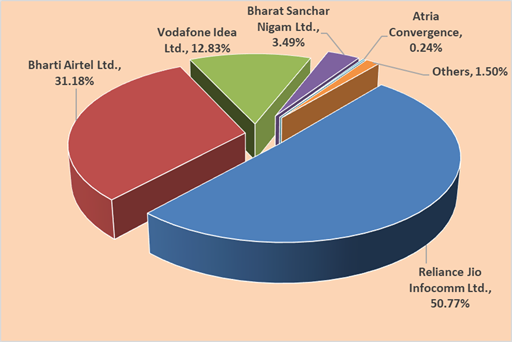

Top Players in Broadband

Reliance Jio tops the chart with 505.47 million broadband users, followed by Bharti Airtel at 310.42 million, Vodafone Idea at 127.78 million, BSNL at 34.71 million, and Atria Convergence at 2.34 million. Together, these five control 98.50 percent of the market.

In wired broadband, Jio has 13.20 million, Airtel 9.80 million, BSNL 4.40 million, Atria 2.34 million, and Kerala Vision 1.42 million. Their combined share is 70.19 percent.

For wireless broadband, Jio leads with 492.27 million, Airtel 300.62 million, Vodafone Idea 127.77 million, BSNL 30.31 million. These dominate almost the entire segment.

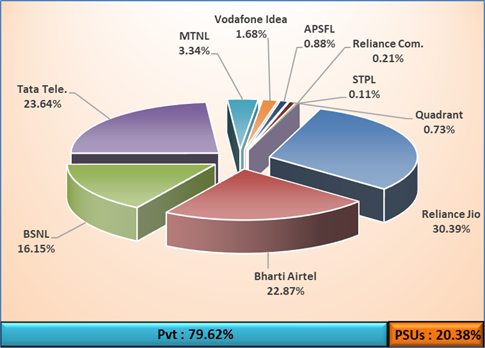

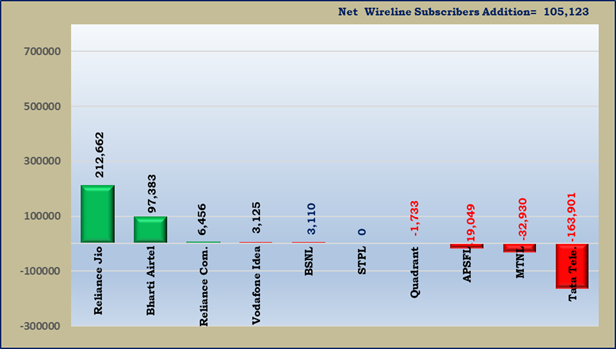

Wireline Holds Steady with Small Gains

Wireline subscribers increased slightly to 46.61 million, adding 0.11 million. Growth rate was 0.23 percent. Urban wireline is 41.64 million, rural just 4.98 million. Public sector providers hold 20.38 percent share here.

Tele-density for wireline is 3.29 percent overall, 8.14 percent urban, 0.55 percent rural. Urban users form 89 percent of wireline base.

People Switching Numbers via MNP

In September, 15.13 million people asked to port their mobile numbers. Zone 1, covering north and west, saw 8.45 million requests, Zone 2 the rest at 6.68 million. UP East led with 2.08 million, followed by UP West at 1.45 million.

Circle Category Performance

Looking at different circle categories, wireless grew everywhere monthly. Circle C showed the highest wireless growth at 0.57 percent. Yearly, Metro circles dipped slightly by 0.20 percent in wireless, but others grew.

Wireline saw gains in Circle B and C monthly, but declines in A and Metro. Yearly, all wireline categories expanded, with Circle A up 39.30 percent.

M2M Connections on the Rise

Machine to machine cellular links grew to 94.57 million. Airtel leads with 56.33 million, then Vodafone Idea, Jio, and BSNL.

Service areas like Delhi have tele-density at 279.33 percent, while Bihar is at 58.02 percent. Eight areas remain below national average.

Most service areas added wireless mobile users, except Jammu Kashmir, Kolkata, and Rajasthan which saw small drops.

These numbers come from reports operators submit to the telecom regulator. Population projections help calculate density figures. Wireless includes fixed wireless, and active user data uses peak visitor location register from switches with purge time under 72 hours.

It is fascinating to see how connectivity keeps expanding, especially in rural pockets and through faster broadband options. With 5G rolling out, expect even more growth ahead. Stay tuned for next month’s update!